back What's Not Being Said Amidst the Lithium Ion Battery Hype (Hint: It's a Double Edged Sword)

May 13, 2015 | Category: Cobalt News

What's Not Being Said Amidst the Lithium Ion Battery Hype (Hint: It's a Double Edged Sword)

By Chris Berry (@cberry1)

For a PDF copy of this note, please click here.

Amid the Tesla-infused hype surrounding batteries a number of truths have become evident.

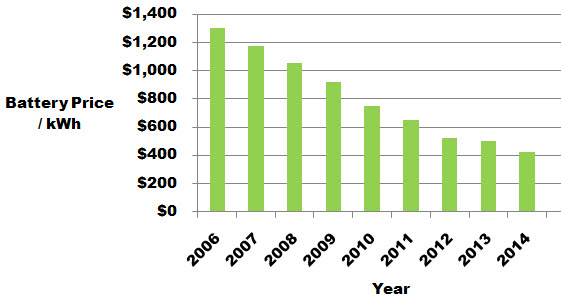

First, battery costs are falling - fast. The overall cost of a lithium ion battery has fallen by over 90% since its commercial introduction in 1990 and the CAGR in the price decrease in recent years per kilowatt hour (kWh) is roughly 14%. Should this rate of decline continue, electric vehicles should be able to compete on total cost of ownership (TCO) with traditional internal combustion engine vehicles within five years.

Source: Industry Data

Second, as trends in urbanization continue and we look to maintain and increase our high quality of life here in the West, the stresses on an antiquated electricity grid accompanied by the need for a reliable grid in other parts of the world will foster innovative solutions. With over 600 million in Africa alone who lack access to reliable electricity, energy efficiency and grid flexibility are sure to be two key areas of opportunity going forward.

Finally, technological advancement and adoption is increasing at an increasing rate. Products like cloud computing, drones, nanoscale drug delivery, or graphene and associated materials science advancements were barely newsworthy a few short years ago and today they are ubiquitous and filled with promise. This pace lends credence to the theme of "Singularity" popularized by Ray Kurzweil. While I am more skeptical than most on "the next big thing", the pace of technology and how it's permeating our lives is impressive.

For these reasons I remain bullish on select energy metals and their supply chains going forward, but it doesn't diminish the challenges to prosperity which occasionally appear to be overlooked. Specifically, high tech supply chain complexities mean that an aspiring entrant could suffer below average returns unless they can prove scalability and absolute lowest cost of production.

As an example of supply chain complexity, Professor Vaclav Smil, in his excellent book titled, "Making the Modern World" describes the supply chain for the iPhone5:

"The teardown on Apple's iPhone5 shows that its major components are made by nearly 20 companies headquartered in the USA, Japan, South Korea, and the Netherlands, with manufacturing facilities in a dozen countries on three continents. For example, NXP Semiconductors, a Dutch company founded by Phillips and headquartered in Eindhoven that supplies the interface for display, manufactures its products in China, Germany, Malaysia, the Netherlands, the Phillipines, Singapore, Thailand, and the UK and uses raw materials that originate in more than half a dozen countries."

You may think that profiling one of the most popular consumer products in the world is an extreme example, but I show this to demonstrate just how complex supply chains are (or can be). Here is another example, further down the value chain involving Albemarle Corp (ALB:NYSE).

Last week, the company reported earnings for Q1 of 2015 and they were interesting as the acquisition of Rockwood was finalized on January 12th and so the impact of Rockwoodd�?s lithium business can finally be "felt" in ALB's earnings. While I won't go into the details (they are here), I do want to point out the performance of the company's lithium business. Gross margins were 29.5% and Adjusted EBITDA margins were 38.7%. This is highly competitive among lithium producers and somewhat of a benchmark for aspiring producers. FMC, another member of the lithium oligopoly, pales in comparison with gross margins of 8.5% and operating margins of 4% in Q1 2015. There does not appear to be a great deal of room for error here and I think the takeaway is that where you invest among producers is as important as where you invest along the value chain.

The situation is quite different further up the value chain. Panasonic (PCRFY:OTCBB, 6752: TYO), one of the largest battery manufacturers in the world and Tesla's (TSLA: NASDAQ) partner in the Gigafactory is only projecting an operating profit margin in FY 2016 of 5.6% in their battery business. The operating margins among battery producers are all similar which indicates that investors should get ready for a bloodbath in the battery producer space. It appears scale will win market share, but at a cost of thin margins. We will be undertaking a more complete study of the battery value chain in a forthcoming note.

Clearly, scale is a double edged sword - it drives down costs for the consumer, but also compresses margins.Â

I use these examples to try and elucidate a fascinating and dynamic industry rather than denigrate it. It will clearly be difficult to drive returns across technology value chains. If 4 to 6% margins are the best we can expect from battery manufacturers, could there possibly be other industries with wider operating margins or the possibility for higher returns?

The mining sector is a somewhat different story. The takeaway, should you choose to remain focused on the mining sector, is that unless the opportunity in question can prove the absolute lowest cost of production likely through leveraging a disruptive technology, above average returns may not present themselves. I donnâ?t see any other realistic way to compete with established competitors.

I remain convinced that more lithium, cobalt, and copper will need to come on stream in the next few years to satisfy the lofty production goals of the battery business. Just how much of each is an open question with myriad answers. It is, however, important to remember that costs still matter more than anything and ignoring this fact will impact margin expansion which is a main driver of above average returns. Â